Real Strategies for Virtual Organizing

Venkatraman, N ; Henderson, John

Sloan Management Review, Fall 1998, Vol.40(1), p.33

Real Strategies for Virtual Organizing.

Authors:

Venkatraman, N.

Henderson, John C.

Source:

Sloan Management Review. Fall98, Vol. 40 Issue 1, p33-48. 16p. 1 Black and White Photograph, 1 Chart.

Document Type:

Article

Subject Terms:

*BUSINESS planning

*MANAGEMENT science

*INFORMATION technology

*KNOWLEDGE management

*ORGANIZATIONAL structure

Abstract:

According to the authors, the current models of strategy and structure are woefully inadequate to meet the imminent challenges of the information age. For two years, the authors undertook a systematic study to conceptualize the architecture of virtual organizing. The authors present their views on the architecture of a business model for the knowledge economy. The authors reject a virtual organization as a distinct structure, and instead treat virtualness as a strategic characteristic applicable to every organization. They view virtualness as a strategy that reflects three distinct yet interdependent vectors: the customer interaction vector (virtual encounter), the asset configuration vector (virtual sourcing), and the knowledge leverage vector (virtual expertise). Each vector of the model has three distinct stages and have traditionally been independent. However, the authors’ view of virtual organizing integrates these three hitherto separate threads into an interoperable information technology (IT) platform that supports and shapes the new business model. The strategic logic for the new business model is rooted in the interdependence among the three vectors. The authors develop their logic of virtual organizing by placing IT at the center, with the belief that the emerging architecture of virtual organizing is not possible without the significant power of IT.

Full Text Word Count:

9920

ISSN:

0019-848X

Accession Number:

1233052

As the possibilities of the information revolution challenge traditional business logic, companies are experimenting with a wide array of strategic alternatives and organizational forms. The appropriateness of the current business model rooted in the industrial economy is questionable. Drucker has outlined his views of a knowledge-based organization. Quinn has documented the shift toward a service-based economy with a focus on intellect. Hamel and Prahalad argue for a critical focus on core competencies and an organizational design that best leverages them. Womack and Jones advocate a lean organization, and Handy paints a shamrock structure.[1] We could cite many more opinions, but the message is clear: the current models of strategy and structure are woefully inadequate to meet the imminent challenges of the information age.

During the past two years, we undertook a systematic study to conceptualize the architecture of virtual organizing. Here, we present our views on the architecture of the twenty-first century business model. We choose the term architecture rather purposefully and define it as “providing a framework for the conduct of life, not a specification of what life should be. Architecture should facilitate, guide, and provide a context; it should not provide a rigid blueprint for conduct.”[2] Moreover, the “building should preferably be ahead of its time when planned so that it will be in keeping with the times as long as it stands.”[3]

We reject a virtual organization as a distinct structure (like functional, divisional, or matrix). Instead, we treat virtualness as a strategic characteristic applicable to every organization; our discussion then is applicable to century-old companies that manufacture cement, chemicals, and autos as well as to new entrants in the fast-changing high-technology marketplace. We view virtualness as a strategy that reflects three distinct yet interdependent vectors:

- The customer interaction vector (virtual encounter) deals with the new challenges and opportunities for company-to-customer interactions. IT now allows customers to remotely experience products and services, actively participate in dynamic customization, and create mutually reinforcing customer communities.

- The asset configuration vector (virtual sourcing) focuses on firms’ requirements to be virtually integrated in a business network, in sharp contrast to the vertically integrated model of the industrial economy. Firms using the Internet for business-to-business transactions can structure and manage a dynamic portfolio of relationships to assemble and coordinate the required assets for delivering value to customers.

- The knowledge leverage vector (virtual expertise) is concerned with the opportunities for leveraging diverse sources of expertise within and across organizational boundaries. IT now enables knowledge and expertise to become drivers of value creation and organizational effectiveness.

No one vector adequately captures the potential opportunities of virtual organizing; their interdependence creates the new business model. We view virtual organizing as a strategic approach that is singularly focused on creating, nurturing, and deploying key intellectual and knowledge assets while sourcing tangible, physical assets in a complex network of relationships. We depart from the current literature on virtual organizing that proposes incremental improvements to the business logic rooted in the industrial age. We develop our logic of virtual organizing by placing IT at the center. The powerful convergence of computers and communication technology and the emergence of the Internet are enablers of this new business model. Nadler and his colleagues indicated that the creation of effective architecture hinges on the use of structural materials capable of implementing the architecture and discussed IT’s power in creating future organizational architecture.[4] In a similar way, we believe that the emerging architecture of virtual organizing is not possible, or constructed effectively, without the significant power of IT.

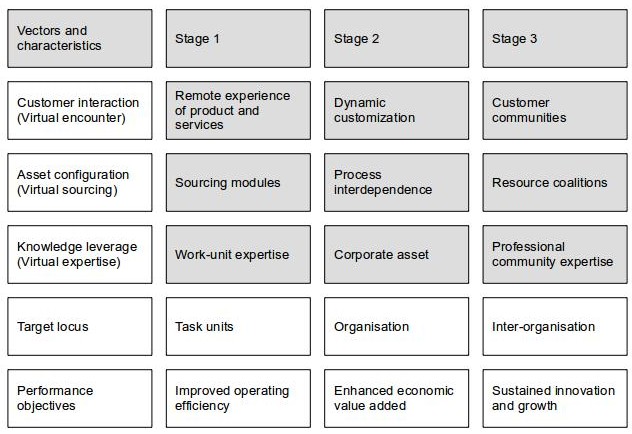

Each vector of our model has three distinct stages (see Figure 1). Stage one focuses on the task units (such as customer service, purchasing, or new product development). Stage two focuses at the organizational level on how to coordinate activities to create superior economic value. The third stage focuses on the interorganizational network to design and leverage multiple interdependent communities for innovation and growth.

These three vectors have traditionally been independent: they focused on isolated functions — marketing, purchasing, and human resources, respectively, with their idiosyncratic processes and information systems. For instance, marketing activities in the customer interaction vector were supported by telephony, call centers, and product simulations. Sourcing or purchasing activities were supported by electronic data interchange (EDI) and CAD/CAM integration between suppliers and manufacturing processes. Decision support systems and groupware supported managerial work. There was historically no common unifying platform to pull these different activities together. However, the increased adoption of enterprise systems like SAP, Oracle, Baan, and Peoplesoft, combined with the rapid acceptance of the Internet protocols, offers the possibility of a common technology platform.

Our view of virtual organizing integrates these three hitherto separate threads into an interoperable IT platform that supports and shapes the new business model. The challenge is to ensure internal consistency across the three vectors and benchmark a profile of virtualness relative to competitors and referent companies in the marketplace. External benchmarking becomes critical as companies experiment with different approaches to design.

Customer Interaction (Virtual Encounter)

The interactions of a company with its customers (and end consumers) in the industrial age occurred through a multistage distribution network involving wholesalers, retailers, customer service agents, and franchisees. The predominant focus was on efficiently distributing products in a linear fashion from manufacturers to consumers. The emerging global, digital economy allows for establishing and leveraging a two-way information link between a company and its customers — albeit through remote and asynchronous mechanisms.[5] This link is possible not only for consumer products and services but also for business-to-business products and services.

Some customers are interacting with companies in new, innovative ways. They are testing products at early concept stages (for example, software and advertising), while others are receiving e-mail replies to problems not covered in product manuals (computers, electronic equipment, and industrial products). Technologically savvy customers are constructing customized news feeds (www.snap.com), reviewing and monitoring financial accounts (American Express, Schwab, or Fidelity), exploring real-estate properties (www.century21.com), or reviewing video news clips (www.cnn.com). Moreover, virtual consumer communities — which alter the traditional consumer role — are emerging.[6]

Corporations face new strategic questions: What are the tenets of marketing for the information age? How can we leverage the functionality of customer interactions in crafting successful marketing strategy? What is advertising’s role under conditions of greater customer pull and fine-grained segmentation? Should we actively create customer communities or participate in them unobtrusively? To address these and related questions, we delineate three stages of customer interaction: remote experience of products and services, dynamic customization, and customer communities.[7]

Remote Experience of Products and Services

To understand this stage, let us examine Sears, Roebuck’s introduction of product catalogs, the first successful attempt at creating a virtual product experience. It simulated key product features from a physical space (storefront) to another physical space (paper), separated by time and distance. Customers experienced the different products through the pages of a catalog and made their purchase without actually seeing or touching the product. Over the years, the catalogs became glossier, mail-order sales increased, and direct marketing became a major force. The information age has created the home shopping television network: consumers virtually experience product features — signaling a shift from atoms to bits, in Negroponte’s words.[8] TV has allowed a more complex, intricate demonstration of features and functionality.

Similarly, the concept of remotely experiencing customer service is also not new but is being redefined. Since the early 1980s, building supervisors have had superior customer service from Otis Elevators’ remote elevator monitoring. Schlumberger remotely reads utility meters; Sony provides PC owners with diagnostics and repair over ordinary telephone lines. GE Medical Systems remotely supports lab technicians in hospitals dealing with medical images, and GE Aircraft Engines remotely tracks the performance of aircraft engines during flight.

More recently, the Internet has accelerated and redefined the possibilities of the remote product or service experience, for example, the real-time monitoring of shipments (www.fedex.com; www.ups.com) or stock portfolios (www.yahoo.com). Airlines are posting fares only for their frequent flyer members through their Web links (see, for instance www.usairways.com.) and bypassing traditional travel agency channels. Retail banks are creating high-tech links with customers (www.wellsfargo.com/home;www.citibank.com); their challenge is to ensure that the sites complement the service delivery at their banks.

The possibility of remotely experiencing products or services has major implications for developing the required business infrastructure. Charles Schwab redefined the brokerage business with a different price-point than full-service brokers and offered a portfolio of channels for customer service (1-800 numbers, branch offices, telebrokers, and e-Schwab). Now, new entrants like E*Trade (www.etrade.com) and Ameritrade (www.ameritrade.com), which do not have a physical presence, further threaten Schwab’s pricing structure. The challenge for companies in information-intensive markets is to manage the velocity of the shift from physical to electronic infrastructures and compete effectively against those entrants that don’t have the constraints of a physical infrastructure.

The same challenge is driving software distributors, such as Egghead, to reassess their distribution strategy: during the past year, Egghead has closed more than seventy traditional software outlets and has opened its first store on the Net. Its on-line storefront (www.egghead.com) features three main rooms — Internet products, business products, and games — with on-line product support. It is entirely relinquishing its presence in the physical marketplace to focus on the electronic marketspace.

The passive distribution of standardized news through traditional channels is also being redefined. Leading newspapers and magazines routinely allow readers to browse their latest issues on the Web: Financial Times (www.ft.com), Computerworld (www.computerworld.com), Fortune (www.pathfinder.com), Wired (www.wired.com), and The Economist (www.economist.com). Nearly all are facilitating interactions between editors or writers and readers.

Traditional selling of textbooks at the beginning of a semester is now relegated to an educational consultant or a value-adding partner throughout the semester. Leading textbook publishers are creating supplementary Web site links to connect students and professors throughout a course (www.mhh.com; www.wiley.com; www.uol.com).

Product Companies. Clearly, consumer product companies like Procter & Gamble, Colgate, Kraft Foods, and consumer durables and business-to-business companies like General Motors, General Electric, Allied Signal, and Caterpillar have crafted their business strategies by leveraging physical assets and developing powerful global brands supported by mass advertising and mass distribution. But remote links with customers apply equally well to these companies. Remote and continuous links with customers become critical as the concepts of brand identity and brand equity are redefined.

Kraft Interactive Kitchen (www.kraftfoods.com) is an example of a consumer products company keeping in touch with its consumers by providing information-based services like meal planners, recipes, tips, and cooking techniques. Kraft’s intent is to have remote connections and interactions with consumers in new ways.

General Motors and its OnStar service uses global positioning system satellite technology and a hands-free, voice-activated cellular phone to link the driver and the vehicle with the OnStar Center. Advisers provide real-time, person-to-person services such as emergency help linked through automatic detection of air-bag deployment, stolen vehicle tracking, route support, remote diagnostics, remote door unlocking, and a variety of travel and personal services. GM can provide information-based services to the driver and even remotely diagnose the car continuously for a fixed service fee (www.onstar.com).

Every company should assess how its products and services can be experienced virtually in the new marketing infrastructure. A Web site is essential. The question is how best to use the Web’s power to create superior linkages with customers.

Dynamic Customization of Product and Services

The second stage of the customer interaction vector focuses on the opportunities and challenges in dynamically customizing products and services. Competitive markets are rapidly eroding margins due to price-based competition, and companies are seeking to enhance margins through customized offerings.[9] Our view of dynamic customization is based on three principles: modularity, intelligence, and organization. Modularity is an approach for organizing complex products and processes efficiently.[10] Intelligence through continuous information exchange with consumers allows companies to create products and processes using the best possible modules. More importantly, dynamic customization of products and services requires an organization that is fundamentally committed to operating in this new way.

Modularity. Product or service modularity requires the partitioning of a task into independent modules that function as a whole within an overall architecture.[11] The classic example of a modular product is IBM’s System/360. The concept has been extended to other industries. For instance, in assembling cars, Toyota, BMW, Mercedes-Benz, GM, Ford, and Chrysler create product platforms that allow modular reuse. The benefits are not only lower unit costs but also greater customer satisfaction; companies can configure automobiles to customer requirements. Modularity also works for services, especially information-intensive services. Take, for instance, personal news feeds (www.cnn.com; www.cnet.com) and customized stock quotes and tracking (www.schwab.com). It is possible to reuse various modules of news and information to construct a customized news service at CNN Interactive and a customized, interactive edition of The Wall Street Journal.

In place of standard textbooks, instructors now assemble textbooks that suit their pedagogical style and objectives by selecting modules from different sources. McGraw-Hill’s College Division pioneered this concept through its Primis offering. Primis users can create a custom textbook from modules within the Primis database and associated databases. Many other textbook companies offer similar configurations.

Intelligence. Dynamic customization is rooted in the deployment of intelligent agent software, such as Firefly (www.firefly.com). Firefly Passport is available to end users who rank Web sites as they surf the Internet. Firefly uses the data to create consumer profiles. Based on an automated collaborative filtering process, Web site operators can match users with similar profiles and make recommendations based on their shared interests. The automated collaborative filtering process lets users receive real-time, personalized listings for items in a site’s catalog of products, services, or content. The result is intelligent sites that learn their visitors’ tastes and deliver dynamic personalized information about products and services. As the Web becomes the main marketing infrastructure and as intelligent agents such as Firefly Passport gain more sustained use on the Web, there will be greater opportunities and pressures for dynamic customization.

A primitive application of automated collaborative filtering appears on sites such as Yahoo’s personalized site (my.yahoo.com), a movie recommendation site (www.filmfinders.com), and Barnes and Noble’s on-line bookstore (www.barnesandnoble.com).

Dynamic customization is possible since these Web sites, supported by agents, leverage in real time each user’s experiences to guide others to relevant content and products. The sites incorporate their entire user base, not just the thoughts of a few experts. Indeed, every search engine is trying to differentiate itself through its superior ability to create custom profiles.

Organization. Ultimately, modularity and intelligence are useless unless the organization design is geared to deliver products and services on a dynamic, adaptive basis. Organizations need to change how they look at marketing processes, shifting from an inside-out perspective to an outside-in perspective. For example, in personal computers, Dell is clearly leading with its dynamic customization offering. Dell’s success relative to others within the computer industry is attributable to its ability to develop an entirely different business model on the concept of building to order.[12] Similarly, the challenge for McGraw-Hill’s Primis division is to move from textbook modularization and go on to create an organization that can deliver educational solutions for customers.

The challenge of dynamic customization rests on greater decomposition of products and services into modules that can be combined to deliver increased functionality. The number of Web transactions will rapidly increase as electronic commerce goes mainstream. Modules will be redefined continuously, and more information will be captured as consumers become comfortable with intelligent agents that work for them. Over time, consumers will expect enhanced customization for fair value in return for aggregators consolidating detailed personal information. Marketers will focus on assembling for modules that deliver customized solutions.

Customer Communities

The most profound aspect of interaction in the virtual model is the emergence of electronic customer communities. These communities signal a power shift from manufacturers to customers: the communities are information-gathering and information-disseminating conduits. Previously, in the industrial economy, consumers could not be effectively linked together across time and space.

Hagel and Armstrong offer five defining characteristics of virtual communities: distinctive focus, capacity to post their content for access to the wider community, appreciation of member-generated content, access to competing offerings, and commercial orientations. They state, “We cannot yet point to a single example of a virtual community that incorporates all five of the defining characteristics.”[13] We contend that customer communities can exist with only the first three characteristics. The last two characteristics — competing offerings and commercial orientations — apply to only a subset of communities.

Some customer communities reflect strong commitment to brands. Harley-Davidson’s site (www.harleydavidson.com) houses the Harley Owners Group (HOG) — a Web site for Harley owners to share their stories and pictures. This community does not overtly create new product sales but does maintain an important link with core customers and enhance brand identity.

Citibank — in partnership with The Mining Company — has created a community on its Web site for customers to learn about Citibank’s products and services. It uses bulletin boards, chat rooms, e-mail, and other features so prospective customers can interact with current customers and receive testimonials directly from them (www.citibank.com; www.theminingco.com).

The Intel Pentium chip case exemplifies the role and power of customer communities even when an organization does not sell its products directly to the end user. The tight-knit user community had access to information about potential problems with Intel’s Pentium chip and forced Intel to act. The community, supported by Usenet groups, made Intel rethink its heuristics for product recall. Intel now has a news-group feature within its site (newsgroups.intel.com) and is actively participating in its customer group. The source of the group’s power came from knowledge (about the performance parameters of the chips), not from scale and volume of purchase. Unlike buying cooperatives, individuals within a customer community retain their rights about brand preferences and purchase decisions.

Amazon.com (www.amazon.com) is often touted as an example of how to leverage the power of customer communities. Amazon has created a virtual bookstore with minimal physical assets and a particular focus on customer relationships. Will Amazon fade away as other serious competitors like Barnes and Noble (www.barnesandnoble.com), Borders (www.Borders.com), and Microsoft (www.books.com) enter the fray? As long as Amazon is able to orchestrate a tight-knit community of avid readers, who create and distribute their own content (in the form of reviews), competitors will have difficulty dislodging and disintegrating this community. The challenge for Amazon.com is to provide balanced reviews rather than only favorable ones.

Consumer communities are in the early stages.[14] Nevertheless, they could exercise significantly greater power in the future and transform the role of marketing. Should marketers orchestrate customer communities for their own products or involve a third party? Companies such as Intel, Harley Davidson, Egghead Software (www.egghead.com), Travelocity (www.travelocity.com), Toyota (owners.toyota.com/entrance.html) and Apple Computer (www.apple.com/usergroups) are forming customer communities around their products and brands.

At the same time, some communities form without the involvement of major sellers. For instance, photography (www.photoshopper.com), automobiles (www.autoweb.com; www.edmunds.com, www.netmarket.com), and some specialized areas like water utility (www.wateronline.com) and air pollution (www.pollutiononline.com) gain credibility largely due to their lack of ownership links to product and service providers. These communities must generate and maintain the consumers’ trust as they collect personal information while providing value-added services.

As virtual organizing becomes more widespread, companies must recognize communities as part of the value delivery system and respond appropriately in their strategies.

Questions for Managers

- Do you have a strategy to virtually connect with your customers that focuses on capturing information and leveraging knowledge? This contrasts sharply to setting up a distribution system that focuses on efficiently distributing products and services.

- Have you developed appropriate mechanisms so customers can reach you twenty-four hours a day, seven days a week? Can customers experience salient product features remotely? Can customers gain access to a databank of answers to frequently asked questions so they can solve some problems themselves? More importantly, how does your remote access capability rank against your competitors and other companies that may do business with your customers?

- How extensive is your capability to customize your products and services over their life cycles? While it is becoming relatively easier to customize the product or service at creation or delivery, the challenge is to dynamically link to the customers to refine features over time.

- Does your organization still reflect a make-to-sell orientation rather than a make-to-order philosophy? The latter is more in line with a sense-and-respond approach to virtual encounters.

- Do you plan to be a passive participant or an active orchestrator in dealing with emerging customer communities?

- How are you assessing your progress in the customer interaction vector as the marketplace demands greater remote access, dynamic customization, and participation in the customer community?

Asset Configuration (Virtual Sourcing)

The second vector focuses on acquiring critical assets and resources, a clear move away from vertical integration toward greater reliance on components obtained from external markets. As they move from an industrial economy, many corporations will concentrate on creating and deploying intellectual and intangible assets while sourcing tangible, physical assets from a complex business network.

Effective contracting for complementary capabilities through a network of suppliers and subcontractors is a characteristic of virtual organizing.[15] Davidow and Malone note: “For a virtual corporation to succeed, it must be closely linked with its suppliers as to create a shared destiny. … Ultimately, even the boundaries between them will become indistinct.”[16] Goldman et al. highlight the importance of close relationships with suppliers and subcontractors to realize efficiency and flexibility — critical indicators of organizational agility.[17] Quinn describes Nike as a model for effective sourcing of manufacturing competencies: “Nike is basically a research, design, and marketing company — outsourcing 100 percent of its athletic footwear manufacturing to numerous ‘production partners’ abroad.”[18]

As corporations refocus on their core competencies and move away from vertical integration, they will obtain complementary assets through interfirm relationships.[19] For example, confectionery companies like Nestle, Mars, and others get their packaging from leading packaging and printing companies. Nike and Reebok get their shoes, based on their proprietary designs, from leading Asian contractors. Chrysler’s turnaround is often credited to its sourcing capabilities, reflected in its relatively higher percentage of contracted parts. Dell’s success is attributed to its superior sourcing strategy. Boeing developed its latest plane, Boeing 777, with a portfolio of relationships among subcontractors and lead customers.

Nearly every major treatise on the logic of new strategy and competition discusses the requirements of effective sourcing of competencies.[20] However, this is not a simple choice between make-versus-buy or vertical integration but involves a continuous reconfiguration of critical capabilities assembled through different relationships in the business network.[21] IT allows the possibility of efficient sourcing of standard modules and creates opportunities for process outsourcing. There are three stages of asset reconfiguration — sourcing modules, process interdependence, and resource coalitions.

Sourcing Modules

The first stage in this vector deals with the benefits of efficiently sourcing standard modules or components. Advances in the industrial age were based on product modularity — building a complex product from subsystems designed independently yet functioning as a seamless, integrated entity. GM, Ford, and Chrysler operate more like assemblers and integrators of subsystems than traditional vertically integrated manufacturers. Baldwin and Clark argue that in a new age of modularity, the value-adding role of a corporation is less in the manufacture of a critical component than in the creation of a product or service architecture.[22] Thus the designer assembles multiple interlocking product modules to deliver a superior solution, while controlling the architecture of the subsystem and its role in delivering value.

For more than a decade, the power of electronic data interchange (EDI) has supported the ability to efficiently source modular products. Wal-Mart pioneered a new retailing model by leveraging a sophisticated EDI network with its suppliers to radically lower its inventory level. In Negroponte’s words, Wal-Mart substituted bits (information) for atoms (inventory) to enhance its operating margins to a level previously unseen.[23] EDI has had a significant role in reducing inventory levels in supply chains within consumer products (Procter & Gamble, Kraft General Foods), athletic shoes (Nike, Reebok), apparel (Gap, Benetton), aircraft parts (Boeing, GE), and computers (Dell, Gateway).

The Web is pushing the ability to source standard product modules even further. Cisco Systems Inc., for example, expects to sell $1.8 billion worth of Internet products. Boise Cascade Office Products (www.bcop.com) has deployed an extranet for its largest 600 corporate customers, and its margins have doubled compared to its traditional operations. Dell is selling more than $3 billion in computers over the Web, mainly to corporate customers like Shell and Boeing.

General Electric’s Trading Process Network (TPN) started as a service to streamline GE’s procurement of standard products within GE Lighting. It has now expanded to cover a broader range of business units. The network links more than 2,500 GE trading partners and accounts for more than $1 billion of procurement in 1997. By initial estimates, TPN has reduced the procurement-cycle time by 50 percent, procurement-process costs by 30 percent, and actual material costs by 20 percent. GE is expected to source more than $5 billion of procurement annually through TPN by 2000.

Sourcing Logic. Services like GE’s TPN force managers to constantly ask: What assets can we obtain from outside without loss of competitive advantage? When should we revise our sourcing logic?

The selection of assets is complicated because their criticality changes over time. In the 1980s, IBM conceptualized the personal computer market around its proprietary architecture. It purchased operating systems from Microsoft (MS-DOS and OS/2) and microchips from Intel. However, as the technology architecture evolved, IBM was left without a critical asset in the changed marketplace. The market shifted from a hardware standard that favored IBM to a new standard based on software (Windows) connected to chips (Intel). So, while IBM’s original sourcing decision might have been efficient and prudent, it could not adapt its sourcing logic to the changing market conditions.[24]

Process Interdependence

The next stage focuses on the interdependence of business processes across organizational boundaries. External specialists can carry out information-intensive business processes without loss of control. During the past few years, several specialist business process firms have emerged in the areas of accounting, inventory control, customer service, call-centers, database analysis, telemarketing, and logistics. Business process outsourcing will continue to increase as more specialist firms emerge in the reconfigured business network. For example:

- DirecTV, which delivers about 150 channels of satellite television programs, is working with MATRIXX, a business unit of Cincinnati Bell, to deliver superior customer service. From its dedicated facility in Salt Lake City, Utah, MATRIXX provides telephone customer service and sales support, which includes equipment dealer referrals, programming sign-up, and complete customer service and account management. MATRIXX is the extension of DirecTV operations by providing more than 2,000 dedicated customer service representatives who handle about 20 million calls a year. This marks the first time a major corporation has entrusted its entire customer service operation to an outside telephone marketing company on such a grand scale. DirecTV has integrated its processes with MATRIXX, thereby leveraging its expertise at managing customer relationships.

- Allegiance Corporation recently spun off from Baxter Healthcare. The company, known for its legendary ASAP system, created a separate entity to focus on logistics and materials management processes.[25] In March 1996, Baxter announced an unprecedented agreement to work with Methodist Healthcare System of San Antonio, a joint-venture partner with Columbia Healthcare System. Under the agreement, Baxter operates a service center to support the consolidation and outsourcing of selected functions within the Methodist Healthcare System and to implement process improvements to reduce costs. More importantly, Methodist is leveraging Baxter’s expertise in three processes: distribution and logistics, operations efficiencies, and resource management. Furthermore, Baxter’s compensation is directly tied to the performance levels of these processes. Allegiance Corporation’s stock price has more than doubled since the spin-off, and the firm has a market capitalization of more than $2 billion.

- Kraft Foods is intertwining its marketing processes with the data collection and analysis at ACNielsen, a leading information provider in the consumer packaged goods industry. The early availability of marketing data through process integration between the two organizations allows Kraft Foods to respond to marketing trends quicker and more effectively than its competitors. Kraft has benefited by reconfiguring its marketing processes across organizational boundaries.

- National Semiconductor (NSC), the thirteenth largest computer-chip maker, entered an agreement in which FedEx manages its logistics operations. In the early 1990s, NSC realized that a major driver of its operational inefficiency was its outmoded process for moving inventory. Since NSC could not achieve the best-in-class process levels of a logistics company without taking valuable resources away from product design and manufacture, it outsourced its processes to FedEx. NSC, through its link with FedEx, has improved its process performance: it moves products from factory to customer in about four days, and its distribution costs have fallen from 2.6 percent of revenues to 1.9 percent.

- FedEx, on the other hand, has become a player in the electronics commerce and logistics marketplace by physically moving goods from far-flung manufacturers to their global customers. Its new service, Virtual Order, takes and processes orders, including arrangements for shipping, provides access to shipment status, and handles customer queries. Indeed, its goal is to become the airline of the Internet. It has combined electronic commerce and logistics operations and acquired Caliber Logistics to ensure a full range of service capabilities.

Process reengineering captured managers’ imagination in the 1980s and early 1990s for one reason: improved operating margins. Now, another shift, process outsourcing, is “the delegation of one or more business processes to an external provider who then owns, manages, and administers the selected processes based on measurable metrics.”[26] This is attractive because of greater asset utilization. As processes become more standardized and as the market matures with more stable participants, many corporations will recognize the criticality of business process outsourcing. Specialized firms like MATRIXX and FedEx can seamlessly carry out customer service and logistics; at the same time, extranets can ensure that firms do not lose control of their processes. Every corporation should assess the benefits and risks of carrying out these processes .themselves. Thus IT is fundamentally affecting the business scope of most organizations.[27]

Resource Coalitions

The third stage in the asset configuration vector focuses on the establishment of a resource network, in which the firm is part of a vibrant, dynamic network of complementary capabilities. A corporation becomes, not a conventional portfolio of products or businesses, but a portfolio of capabilities and relationships. Every organization is either implicitly or explicitly positioned in a network of resources where it acquires complementary capabilities. Corporations are increasingly relying on external sources not only for support activities but also for critical resources. Positioning a firm within a broader network of resources in the marketplace is a driver of competitive advantage. Consequently, the strategic leadership challenge is to orchestrate an organization’s position in a dynamic, fast-changing resource network. Three examples help illustrate the benefits of resource coalitions:

- When viewed as a portfolio of capabilities through relationships, Nike is a new breed of organization that has positioned itself strategically within a network of complementary resources. Nike assembles the required capabilities through a coalition, including production subcontractors in Asia, ad agencies (Weiden-Kennedy), web support (Vivid Publishing), retail outlets (Footlocker), exclusive contracts with athletes (Michael Jordan, Tiger Woods, Andre Agassi), preferred contracts with professional teams (Dallas Cowboys), and universities (Ohio State football, University of North Carolina basketball). Nike’s advantage is based on the superior orchestration of its position in the resource coalition. As its competitors strive to construct similar coalitions to neutralize Nike’s advantage, Nike’s success will depend on proactively adapting its network to respond to new market requirements.

- Charles Schwab has successfully evolved from an undifferentiated discount broker to a key player through its offering, OneSource. Schwab positioned itself within a resource coalition composed of independent financial advisers (who act on behalf of individual investors), a broad array of financial product companies (mutual funds, stocks, initial public offerings, debit cards, and life insurance), providers of research reports, and several technology firms (supporting its e-schwab service). This vigorous network underpins Schwab’s competitive advantage. While individual elements of the network can be imitated, Schwab’s ability to integrate the different facets coherently is distinctive. Its future success will be fundamentally based on its ability to adapt this network to changing market and competitive conditions.

- As part of Amazon’s attempt to create a powerful business model, it is orchestrating affiliated sites as associates to serve as extended bookstores. The associates establish their own bookstores on their Web sites or place banners and logos to direct traffic to Amazon’s site. In return, they receive a commission on books purchased through their referrals. For instance, a search on Alta Vista triggers an opportunity to order books on the selected topic. Amazon’s success will be significantly affected by its ability to centrally position itself in the constantly reconfiguring resource network.

Participation in Resource Coalitions. In the virtual integration model, one firm does not dominate all others in a network. Thus every firm balances its leadership position relative to one set of resources, with secondary roles related to other complementary resources. For instance, IBM is dominant in the mainframe computer architecture while it follows standards established in other areas (e.g., Windows-Intel architecture). Similarly, Fidelity distributes its funds through Schwab while aggressively promoting its own Funds Network as an alternative. Those companies that can carefully analyze their relative dependence on other players in their resource coalition and ensure their unique capabilities will be successful.

Every organization is dependent on relationships for assembling complementary capabilities. Starbucks has emerged as a major coffee retailer with sales of more than $1 billion and a 6.3 percent return on investment. More impressive is its stock market capitalization — more than $5 billion in June 1998. Instead of committing its internal resources to build a brand image, Starbucks has formed a virtual network of complementary players into a coalition of United Airlines, Marriott and Westin Hotels, Star Market, Pepsi, and Barnes and Noble, among others. In doing so, it has created a level of brand equity far greater than its level of resource deployment.

Shifting Value Drivers. The importance and relative priority of resources changes over time. IBM, Apple, and Motorola pooled their resources to create the PowerPC. However, they could not establish a viable alternative to Windows95/NT and abandoned the coalition. Now they are part of the resource network dominated by Microsoft and Intel. More recently, IBM, Sun, and Oracle formed a network to establish the Network Computer (NC) as an alternative to the Wintel platform.

Such coalitions highlight another important characteristic of virtual organizing: the blurred distinction between competition and cooperation. Every company is positioned within a resource network and simultaneously plays both competitive and cooperative roles. Shell and Amoco have pooled most of their west Texas oil fields to make upstream operations more efficient, while competing with each other in retailing. BP and ARCO Alaska have a cooperative agreement on maintenance, operations, procurement transport, and drilling, while they compete in other areas of the value chain. Blurring boundaries are also evident as Netscape, Sun, Microsoft, Oracle, Apple, IBM, Digital, Intel, and others simultaneously try to establish superiority and distinction on the Internet while recognizing the need for interoperable technology architecture. Knowing where and how to add value is important to strategy development in this new game of co-opetition (the logic of combining cooperation and competition).[28]

Creating a resource coalition and navigating under fast-changing market conditions is not simple. Rule makers in a resource coalition can lose their ability to set rules while internal and external conditions change, as in the IBM PC case. Similarly, Apple, which had a central position in the resource coalition for the personal digital assistant (when it introduced Newton), lost its position to Pilot, Hewlett-Packard, and Casio. Similarly, Xerox did not capitalize on its early lead in the graphical user interface. Digital’s resource coalition faltered, while Microsoft, Sun, and Intel gained their positions due to superior resource networks.

Questions for Managers

- Does your organization have a logic for sourcing that distinguishes the assets to manage inside from those that can be assembled via relationships in the business network?

- Do you have a systematic approach for identifying the modules that you can obtain from external partners? How efficient is your sourcing process compared to companies such as GE’s TPN?

- Do you consider process outsourcing as the best way to allocate internal resources to high-value-adding areas? More importantly, do you still carry out processes internally that may best be done outside?

- Can your sourcing strategy dynamically respond to make-partner-buy decisions? Is it structuring and managing a portfolio of relationships for obtaining the required capabilities?

- Can you create interdependencies within your processes across organizational boundaries? Are they seamless and supported by IT?

- How well are you balancing dependence on partners in the resource coalition with their dependence on you? Are the coalition partners favoring you over your competitors (who may also overlap with the network for accessing similar resources)?

- How are you assessing your progress in this vector as you strive to efficiently source modules, reconfigure processes, and orchestrate a superior position within the resource coalition? Do you have a scorecard of financial and operational metrics to monitor your performance?

Knowledge Leverage (Virtual Expertise)

The current trend is toward greater employment opportunities in smaller companies, fewer permanent or guaranteed jobs, more work done at remote locations, greater reliance on contract workers, and greater utilization of teams. Drucker has asserted that companies are shifting “from the command and control organization, the organization of departments and divisions, to the information-based organization, the organization of knowledge specialists.”[29] The basic economic resource is not land, physical resources, or capital but knowledge and intellectual assets.[30] In Quinn’s view of an intelligent organization rooted in knowledge: “These knowledge assets can disintermediate bureaucracies, dramatically lower overhead costs, support rapid execution of strategies, and substantially increase the learning rate of employees and their response to customers.”[31] Both imply that effectiveness comes from leveraging intellect and knowledge rather than from economies of scale in operations or physical sources of advantages.

This vector complements the logic of virtual organizing in the previous two vectors. Here we focus on the possibilities and mechanisms for leveraging expertise at many levels. Senior managers face these questions: How do we recognize and leverage knowledge as a corporate asset? How should we manage knowledge workers when human resource policies are geared toward production and administrative workers? How do we design processes for leveraging knowledge when most processes are designed for cost optimization and efficiency? What mechanisms should we use for leveraging tacit knowledge, since we have focused previously on explicit (codified) knowledge? What incentives and compensation practices (like stock options) will attract and keep knowledge workers? To address these and related questions, we delineate three stages of knowledge leverage: harnessing work-unit expertise, recognizing knowledge as a corporate asset, and gaining access to broad professional community expertise.

Work-Unit Expertise

Recently, the redefinition of tasks has been accompanied by more work being distributed across time and distance. More tasks can be decomposed so they can be done at different locations and time periods (for example, customer service, order fulfillment, or new product development). However, their effectiveness is ensured through the deployment of integrated control systems supported by groupware.

The expertise to carry out the tasks of a work unit, to achieve performance improvement as a team, cannot be achieved by individuals. American Airlines deployed an expert system, Smarts, to complement its reservation system, Sabre, so sales representatives could develop target promotional programs to increase its market share and profitability.[32] Merrill Lynch’s success is attributed to its ability to codify and distribute high-level analytical skills to its different work units.[33]

Hewlett-Packard faced the challenge of capturing the knowledge from the use and support of its complex global products. Customers needed support that involved constantly changing technical configurations. In 1995, HP created a case-based reasoning tool to capture technical support knowledge for possible use by service and support personnel worldwide. This initiative has made the distributed service work unit effective: the average time for calls has been reduced two-thirds, and the cost per call has been lowered 50 percent.[34]

An organization’s ability to make processes effective is increasingly supported by improvements in IT functionality like groupware (Lotus Notes), videoconferencing, and intranets that facilitate team-level coordination and exchange of information and knowledge. Teams develop effective routines for sharing knowledge and expertise. Consulting companies have created successful models of knowledge sharing within teams that are not in the same time zone. Pharmaceutical companies have deployed new product development teams that take advantage of the twenty-four-hour clock by distributing work to teams in different time zones. Teams in financial services firms work around the clock to create products and service clients in the global financial marketplace.

Case-based reasoning tools (like the HP case), expert systems, neural nets, and the Web allow firms to capture and leverage knowledge to these distributed processes on a global basis. The real challenge in maximizing work-unit expertise lies not in designing the technological platform to support group work but in designing the organization structure and processes. What is the best way to bring different perspectives into a task team? How do we balance the need for colocation with the requirement to get the best possible expert? How do we design the performance assessment system for the work unit so that it encourages teamwork rather than individual performance? Many companies like Honda, Unilever, Johnson & Johnson, Motorola, GE, Boeing, Kodak, Xerox, and others are experimenting with structures, processes, and technologies that maximize work-unit expertise as they move away from functionally based organizations to a process-driven approach.

Corporate Asset

This second stage focuses on harnessing the collective expertise across work units, rather than within units. The main focus is less on tangible and codified knowledge and more on tacit knowledge to collectively leverage. Both Xerox and BP treat knowledge as a corporate asset, one of the new drivers of bottom-line profits and top-line growth.

- Xerox captures knowledge about new ways of servicing its machines. Many different knowledge workers — customer service engineers, field service engineers, and product specialists — created the Eureka process, which rests on a database called Tips. Key to this process is the emphasis on validation of expertise and knowledge. After a “tip” (an idea or suggestion to solve a problem) is submitted, tip authors can monitor its progress through the validation process, and the originator’s contribution is recognized. They can observe all the comments and interact with validators. The tip is seen not as the asset of an isolated department or a function but of the corporation.[35]

- Starting in 1995, BP has experimented with a virtual teamwork program. When equipment fails in the North Sea, the drilling engineers haul the faulty hardware in front of a tiny video camera connected to BP’s virtual teamwork stations. Using a satellite link, they can call a drilling equipment expert in Aberdeen who can visually inspect the part while talking to the shipboard engineers. Thus distributed expertise is virtually brought to bear on the problem that requires time-sensitive response.[36] According to John Browne, group chief executive, British Petroleum: “Advances in communications technology — particularly high bandwidth communication and information systems — allow the people working on a field in the North Sea to talk directly and to share experience with the people working offshore on a field in the Gulf of Mexico 5,000 miles away.”[37]

Consulting organizations like Arthur Andersen, McKinsey, KPMG, and others are also focusing on identifying, capturing, and leveraging their knowledge assets. Arthur Andersen combined convergent and divergent systems; the former focuses on codified information translated into knowledge and communicated through standard channels at prespecified intervals; the latter is a knowledge-creating system based on information not codified but disseminated in real time. Similarly, the World Bank is repositioning itself as a provider of knowledge-driven services (www.worldbank.org). According to James Wolfensohn, president of the World Bank: “We need to become, in effect, the Knowledge Bank.”[38]

Common to these examples is the notion that knowledge (or intellectual assets) is a corporatewide asset that should be systematically managed. At the U.S. Army’s Center for Army Lessons Learned (CALL) during the 1994 Haiti invasion, CALL experts interviewed soldiers about incidents with mobs and confrontation with local authorities, observed after-action reviews (AARs), and read intelligence reports to compile lessons. CALL developed twenty-six training scenarios for replacement units getting ready for Haitian duty; in the following six months, the units encountered twenty-three of the twenty-six scenarios. Similarly, the CALL process helped the army in Bosnia with early reports of incidents and the consequent distillation of likely actions.[39] Companies like Motorola, GE, Steelcase, BP,[40] and GM[41] are beginning to use the AARs developed by the army — each developing their own scenarios or lessons.

Professional Community Expertise

In the third stage, the focus is on the community of professional expertise — well beyond the domain of a focal organization. For instance, 1,000 staff people at BP collaborate with more than thirty of their partners and suppliers through a virtual team platform, desktop collaboration, information-sharing tools, and videoconferencing. Through coaching, BP has been able to transfer tacit knowledge across boundaries.

Organizations are increasingly leveraging the expertise in the extended network (suppliers, customers, partners, alliances, and so on) and the broader professional community. For instance, some firms retain a core of experts on their payroll while contracting for other skills as needed. Unlike contract workers who smooth out fluctuating demand, this expertise is for specific tasks and is often connected electronically. The knowledge of lawyers, medical practitioners, advertising executives, investment bankers, and technology gurus is often leveraged within an extended community through electronic networks.

Recent advances in IT — especially the deployment of a global, accessible, collaborative infrastructure — fundamentally enable this virtual leveraging of expertise in the professional network. It is possible to get a second opinion on a medical procedure by allowing other experts to view the complete medical history and associated images from remote locations. Multiple experts from different locations can simultaneously interpret the meaning of an unforeseen event like a currency crisis in Mexico or Europe or realignment in the exchange rate between the U.S. dollar and the Japanese yen. As companies identify and integrate expertise from multiple sources, they face the challenge of how best to compensate and motivate employees with expertise. The traditional employment contract might have to be replaced with a more specific contract linked to the leverage of expertise.

Emergent virtual communities serve as a primary mechanism for collecting and legitimizing knowledge and expertise. The Motley Fool (www.fool.com) is one example; more such communities will likely emerge.

Amazon is strategically positioning itself in the knowledge network to include book reviewers and critics, technology developers who constantly push Amazon to the cutting edge of the Web platform, logistics experts who optimize the physical distribution of books, and sociologists who study the emerging patterns of electronic communities. Amazon needs a wide range of expertise if it is to be at the top of this new business model. The knowledge network from the community is more important as it expands beyond books to include movies, CDs, and other products for the same customers. Its ability to leverage the knowledge and expertise of its community might help Amazon maintain its leadership position.

Questions for Managers

- Does your organization recognize the importance of knowledge and intellectual assets in creating value? If so, what are the mechanisms (formal and informal) for implementing?

- How well are your task units (teams and groups) leveraging their collective expertise? What characteristics of the IT platform support knowledge leveraging within the unit?

- Do you treat knowledge as a corporate asset? If so, how is knowledge linked to organizational effectiveness?

- Are you effective in positioning your professional expertise within a community relevant for your business? What is your position in the community, relative to your competitors?

- What qualitative and quantitative indicators are you adopting to better leverage knowledge in creating value? What companies do you use for benchmarking?

Nine Challenges for Transition

The implications of making a transition to the new business model are:

- Shifting value drivers. Every corporation should develop a systematic approach to recognizing and responding to shifts in what drives value. Microsoft, Intel, Starbucks, Amazon.com, Yahoo!, BP Exploration, and others are focusing on knowledge as drivers of their business capabilities. The stock market values these firms for their intellectual assets more than for their physical assets. Recognizing the shift and responding to it is key.

- Designing the new business model. The business model is a coordinated plan to design strategy along all three vectors rather than leading in any one vector. Strategies should recognize the interdependencies among the three vectors.

- Governing beyond outsourcing. Sourcing has become a primary aspect of the strategic logic. Companies should develop a strategic approach to governance that constantly shifts the management of tangible assets to the market where the market is mature. At the same time, they should focus on the governance of value-added intellectual assets inside.

- Interacting with customers for knowledge leverage. Distribution channels are a strategic link with customers for gaining access to critical knowledge. Customers increasingly participate in the product or service development processes much earlier and provide useful information for enhancing product value. More importantly, participating in the customer communities enables a company to be in the midst of information flows about new product features.

- Navigating across multiple communities. Market leaders are differentiated by their ability to position themselves in a network of communities — customer communities, resource coalitions, and professional communities. Companies need to play various roles within these communities — sometimes active, otherwise passive; setting rules sometimes while following rules at others; and competing and cooperating with the same firm at different times or in different settings.

- Deploying an integrated IT platform. Market leaders should design an integrated IT platform for the new virtual business model. They should experiment with various technological alternatives as they strive to align their business strategy with the IT strategy. The Internet (including intranets and extranets) makes possible a common platform that allows for inter- and intraorganizational coordination on a scale not previously possible. IT is both a cause (disruption of market equilibrium) and a solution (building blocks for the new organizational logic). The technology requirements for the three vectors are converging, thus compelling managers to take a more central look at the IT platform. Senior managers cannot simply delegate responsibility to operating managers to execute an information strategy that supports the business strategy. The requirement of continually aligning business and IT strategies is now more important than ever before.

- Allocating resources under increased uncertainty. Leaders are differentiated by how they allocate critical resources. Under conditions of relative certainty, companies can adopt predictable models of resource allocation (for example, the discounted cash flow and traditional net present value calculations). However, the future is expected to be uncertain. Leaders should adopt the discipline of the real options approach to actively allocate resources.[42] That approach brings the discipline of financial markets to strategic decisions and calls for senior managers to actively manage investments to respond to changes in external and internal conditions.

- Designing an organization for knowledge leverage. Companies are experimenting with many different organizational forms that overcome the limitations of existing structures and processes. The underlying logic for new forms should be to leverage knowledge across multiple levels — within and across boundaries. There are no strict or rigid principles for designing organizations that leverage knowledge, but companies will converge on some principles as new entities design organizations without the constraints of the old principles.

- Assessing performance along multiple dimensions. Managers should move away from static, myopic metrics like market share, as they become meaningless with changes in market definition. Similarly, they should supplement accounting metrics like ROI, ROA, and ROE with more contemporary metrics like EVA (economic value added), MVA (market value added), and metrics that capture the share of new wealth creation. Clearly, Yahoo! and Amazon.com are not successful if we look at their profitability numbers but are successful from a stock market valuation viewpoint.

While virtual organizing is a powerful concept, “virtual organization” is an unfortunate term. It connotes impossibilities such as a “hollow corporation” or a “broker.” Virtual organizing as a concept focuses on the importance of knowledge and intellect in creating value. Our approach recognizes three interdependent vectors — virtual encounter, virtual sourcing, and virtual expertise — supported by a powerful, integrated IT platform. The strategic logic for the new business model is rooted in the interdependence among the three vectors. It will be difficult — if not impossible — to craft an effective strategy and structure without harmony among the three vectors.

Virtual Organizing: Three Vectors and Three Stages

Legend for Chart: A - Vectors and Characteristics B - Stage 1 C - Stage 2 D - Stage 3 A B C D Customer Interaction Remote experience of products and (Virtual Encounter) services Dynamic customization Customer communities Asset Configuration Sourcing modules (Virtual Sourcing) Process interdependence Resource coalitions Knowledge Leverage Work-unit expertise (Virtual Expertise) Corporate asset Professional community expertise Target Locus Task units Organization Inter-organization Performance Improved operating efficiency (ROI) Objectives Enhanced economic value added (EVA) Sustained innovation and growth (MVA)

PHOTO (BLACK & WHITE): Harmony among three vectors — customer interaction, asset sourcing, and knowledge leverage — and a strong IT platform form the strategy and structure of a business model for the knowledge economy.

This paper is based on a research project with a grant from the Advanced Practices Council (APC) of the Society for Information Management (SIM) titled: “Avoiding the Hollow: The Building Blocks of Virtual Organizing.” We thank Madeline Weiss, Bob Zmud, Lee Sproull, and members of the SIM-APC and Boston University Systems Research Center for sharpening the framework and developing the management implications. This work was also supported by the National Science Foundation under Grant No. SBR 9422284 (Principal Investigator: N. Venkatraman). Any opinions, findings, conclusions, or recommendations are the authors’ and do not necessarily reflect the views of the National Science Foundation. We also thank Lee Sproull for stimulating our thinking about knowledge networks and the role of communities and PR. Balasubramanian for useful comments.

1. P. Drucker, Post-Capitalist Society (Oxford, England: Butterworth Heinemann, 1993); J.B. Quinn, Intelligent Enterprise (New York: Free Press, 1992); and G. Hamel and C.K. Prahalad, Competing for the Future (Boston: Harvard Business School Press, 1994). Womack and Jones coined the term “lean organization” to extend the original concept of lean production. See: J.P. Womack, D.T. Jones, and D. Roos, The Machine That Changed the World (New York: Rawson Associates, 1990). C. Handy, The Age of Unreason (Boston: Harvard Business School Press, 1989).

- 2. See, for instance: D. Nadler, M. Gerstein, R. Shaw, and associates, Organizational Architecture: Designs for Changing Organizations (San Francisco: Jossey-Bass, 1992).

- 3. S.E. Rasmussen, Experiencing Architecture (Cambridge, Massachusetts: MIT Press, 1991).

- 4. Nadler et al. (1992).

- 5. For an overview of the characteristics of the new marketspace, see: J.F. Rayport and J. Sviokla, “Managing in the Marketspace,” Harvard Business Review, volume 72, November-December 1994, pp. 141-150.

- 6. See J. Hagel III and A.G. Armstrong, Net Gain: Expanding Markets through Virtual Communities (Boston: Harvard Business School Press, 1997).

- 7. When we refer to customer, we include both customers and end-consumers.

- 8. N. Negroponte, Being Digital (New York: Alfred A. Knopf, 1995).

- 9. See, for instance: J.B. Quinn, J. Baruch, and K.A. Zien, Innovation Explosion (New York: Free Press 1997); see also: A.J. Slywotsky and D. Morrison, The Profit Zone (New York: Times Business, 1998).

- 10. C. Baldwin and K. Clark, “Managing in an Age of Modularity,” Harvard Business Review, volume 75, September-October 1997, pp. 84-93.

- 11. B.J. Pine III, Mass Customization (Boston: Harvard Business School Press, 1993).

- 12. M. Dell, “The Power of Virtual Integration,” Harvard Business Review, volume 76, March-April 1998, pp. 73-84.

- 13. Hagel and Armstrong (1997), p. 37.

- 14. For an overview, see Hagel and Armstrong (1997).

- 15. In this paper, we use the terms competencies and capabilities interchangeably. The main distinction in our view is that Prahalad and Hamel use the term competencies in their paper more narrowly to refer to technology-based competencies. See: C.K. Prahalad and G. Hamel, “The Core Competence of the Corporation,” Harvard Business Review, volume 68, May-June 1990, pp. 79-91. For a broader view, see: G. Stalk, P. Evans, and L.E. Shulman, “Competing on Capabilities: The New Rules of Corporate Strategy,” Harvard Business Review, March-April 1992, pp. 5769. We adopt a broader definition when using the two terms interchangeably.

- 16. W. Davidow and M Malone, The Virtual Corporation (New York: Harper Collins, 1992).

- 17. S. Goldman, R. Nagel, and K. Preiss, Agile Competitors and Virtual Organizations (New York: Van Nostrand Reinhold, 1995).

- 18. Quinn (1992).

- 19. See Quinn (1992); and R. Venkatesan, “Strategic Sourcing: To Make or Not to Make,” Harvard Business Review, volume 70, November-December 1992, pp. 98-107.

- 20. See, for instance: J. Lewis, The Connected Corporation (New York: Free Press, 1995); Quinn (1992); and B. Gomes-Casseres, The Alliance Revolution (Cambridge: Harvard University Press, 1996).

- 21. See, for instance: Venkatesan (1992).

- 22. Baldwin and Clark (1997).

- 23. Negroponte (1995).

- 24. For more details, see: H.W. Chesbrough and D.J. Teece, “When Is Virtual Virtuous? Organizing for Innovation,” Harvard Business Review, volume 74, January-February 1996, pp. 65-73.

- 25. See J. Short and N. Venkatraman, “Beyond Business Process Redesign: Redefining Baxter’s Business Network,” Sloan Management Review, volume 34, Fall 1992, pp. 65-73.

- 26. G2 Research.

- 27. See N. Venkatraman, “IT-Enabled Business Transformation: From Automation to Business Scope Redefinition,” Sloan Management Review, volume 35, Winter 1994, pp. 73-87.

- 28. See A. Brandenburger and B. Nalebuff, Co-opetition (New York: Currency Doubleday, 1996).

- 29. R Drucker, “The Coming of the New Organization,” Harvard Business Review, volume 66, January-February 1988, pp. 44-53.

- 30. See, for instance: T. Stewart, Intellectual Capital (New York: Currency-Doubleday, 1997).

- 31. Quinn (1992), p. 102.

- 32. N. Venkatraman and E. Christiaanse, “Electronic Channels for Expertise Exploitation: An Empirical Test of the Airline-Travel Agency Relationships,” Academy of Management Best Paper Proceedings, 1996.

- 33. See J.B. Quinn, P. Anderson, and S. Finkelstein, “Managing Professional Intellect: Making the Most of the Best,” Harvard Business Review, volume 74, March-April 1996, pp. 71-80.

- 34. See T. Davenport and L Prusak, Working Knowledge: How Organizations Manage What They Know (Boston: Harvard Business School Press, 1998).

- 35. See D. Bell, D. Bobrow, O. Raiman, and M. Shirley, “Dynamic Documents and Situated Processes: Building on Local Knowledge in Field Service,” in T. Wakayama, S. Kannapn, C.M. Khoong, S. Navathe, and J. Yates, eds., Information and Process Integration in Enterprises: Rethinking Documents (Norwell, Massachusetts: Kluwer Academic Publishers, 1997).

- 36. Field research at Boston University School of Management, Systems Research Center, 1997.

- 37. J. Browne, speech, “Science, Technology, and Responsibility” (London: Royal Society, 28 October 1997).

- 38. J. Wolfensohn, 1996 annual meeting speech. Available at www.worldbank.org/html/extdr/extme/jdwams96.htm.

- 39. See G.R. Sullivan and M. Harper, Hope Is Not a Method.’ What Business Leaders Can Learn from the Army (New York: Broadway Books, 1996).

- 40. Field research at Boston University School of Management, Systems Research Center.

- 41. Boston University School of Management, research on knowledge management.

- 42. See M. Amram and N. Kulatilaka, Real Options: Managing Strategic Investments in an Uncertain World(Boston: Harvard Business School Press, 1998); and N. Kulatilaka and N. Venkatraman, “Are You Preparing to Compete in the New Economy? Use a Real Options Navigator” (Boston: Boston University School of Management, working paper, August 1998).

Reprint 4013

~~~~~~~~

By N. Venkatraman and John C. Henderson

N. Venkatraman is the David J. McGrath, Jr. Professor of Management and John Henderson is professor of management, both at Boston University School of Management. In addition, N. Venkatraman is principal and John Henderson is the director at the Boston University Systems Research Center.

Copyright of Sloan Management Review is the property of Sloan Management Review and its content may not be copied or emailed to multiple sites or posted to a listserv without the copyright holder’s express written permission. However, users may print, download, or email articles for individual use.